We have a limited amount of discretionary money to spend each month. Discretionary money is what’s left after all the bills are paid. We could spend it on things that return fleeting pleasure like dining out or going for a drive. But what about if we spent it on something that reduced our mountounaius monthly energy bills? A strange thing happens then – we have lower bills and more money left over next month. And if we do the same again next month, we have more and more money, and smaller and smaller bills. This is the sweet art of investing in energy savings. Plugging up the gaping holes through which our hard earned money pours out.

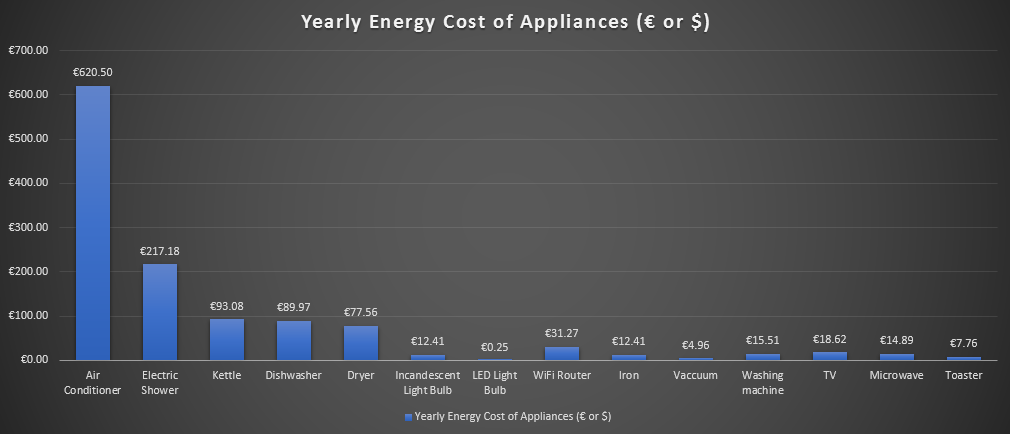

But how do we know how to spend our money to save the most in the future? This is what the electricity costs for most common appliances in the house:

But how do we know how to spend our money to save the most? It’s actually pretty simple now that we have an energy monitor which tells us exactly what everything in our house costs to run.

We can now use this to figure out how much electricity things are consuming in the house and how much that’s costing us. That allows us to rank the worst offenders in order of how bad they are. We then look at how much it would cost to replace that item with a model which would save money in the long run. If the light bulbs currently in the house cost €10 to power each month and it would cost €60 to replace them with LEDs consuming almost no energy, then this change would pay for itself in 6 months. After that time, you will have €10 extra a month to spend on whatever you like. This is known as the payback period, and we can use it to easily work out what would return the greatest bang for our buck, and hence what we should do next.

Some simple maths:

- (Wattage × Hours Used Per Day) ÷ 1000 = Daily Kilowatt-hour (kWh) consumption

- Daily kWh consumption × number of days used per year = annual energy consumption

- Annual energy consumption × utility € or $ rate per kWh = annual cost to run appliance

What is a kWh? kWh means kiliwatt hour. It’s a unit of energy consumption. It’s used by your utilities to measure the energy you’ve consumed. If you run an appliance which consumed 1kw for one hour, it has consumed 1kWh.

For example:

- Our kettle is used about 12 times per day. At 5 minutes a boil, it runs for about 1 total hour (5 minutes x 12 runs).

- Looking at the energy monitor when it’s in use, it consumes 1500W (or 1.5kW) when boiling water.

That’s all the information we need to work out:

- Daily Kilowatt-hour (kWh) consumption: (1,500 W × 1 hour) ÷ 1,000 = 1.5 kWh

- The annual energy consumption: The kettle is used almost every day of the year so that’s 1.5 kWh × 365 = 547.5 kWh per year

- The annual cost: The utility rate is €0.17 cents per kWh. 547.5 kWh × $0.17/kWh = €93.08/year (that’s $103.40)

Hence, it costs €93 a year ($103) a year to run a kettle. If I could buy a more efficient kettle for €100 which reduced the running cost by €50 per year, the kettle would pay for itself in two years and save me €500 over the following ten.

If we work this out for all of our appliances / energy demands in our lives, understand what a more energy efficient alternative would cost and what it would save, we get a ranked list of energy investments which will save us a lot of money. Number one on the list is what you should do next.

If you haven’t managed to get an energy monitor yet, here’s a rough guide as to what things around the house consume:

| Appliance | Consumption (Watts) | Hours per Day | (kWh)Daily Energy Consumption | Yearly Energy Consumption (kWh) | Yearly Energy Cost of Appliances (€ or $) |

| Air Conditioner | 2500 | 4 | 10 | 3650 | €620.50 |

| Electric Shower | 7000 | 0.5 | 3.5 | 1277.5 | €217.18 |

| Kettle | 1500 | 1 | 1.5 | 547.5 | €93.08 |

| Dishwaher | 1450 | 1 | 1.45 | 529.25 | €89.97 |

| Dryer | 1250 | 1 | 1.25 | 456.25 | €77.56 |

| Incandescent Light Bulb | 50 | 4 | 0.2 | 73 | €12.41 |

| LED Light Bulb | 1 | 4 | 0.004 | 1.46 | €0.25 |

| WiFi Router | 21 | 24 | 0.504 | 183.96 | €31.27 |

| Iron | 1000 | 0.2 | 0.2 | 73 | €12.41 |

| Vaccuum | 400 | 0.2 | 0.08 | 29.2 | €4.96 |

| Washing machine | 500 | 0.5 | 0.25 | 91.25 | €15.51 |

| TV | 150 | 2 | 0.3 | 109.5 | €18.62 |

| Microwave | 800 | 0.3 | 0.24 | 87.6 | €14.89 |

| Toaster | 1250 | 0.1 | 0.125 | 45.625 | €7.76 |

If you want to calculate these for your own house, you can use the spreadsheet here, but this will likely be a good approximation for your house. If you don’t use air conditioning, then you’re already on the way to spending less on energy.

As we can see from the chart – there are a lot of low hanging fruit to improve and save us money!

Now for a payback calculation. The electric shower costs €217.18 to run every year to heat the water required for 30 minutes of showers per day. A house will also require heating, at least in winter, usually by heating water and circulating it around the radiators. This may be done with gas, oil, hot water solar, etc. Our house has a gas boiler which cost €828.88 per year to run (that’s 13,813 kWh of gas used per year emitting 3,177 kgCO2 – more on calculating these figures later). That’s €828.88 + €217.18 = €1,046.06 a year to heat water.

I am in a position where I can access wood for quite a bit cheaper than gas so I priced having a wood burning stove installed in the house with a back boiler to heat the water for the house. The stove, back boiler, new highly insulated hot water tank and plumbing came to €4000. I estimated that the running costs (e.g. the wood) would cost €155 per year. That all adds up to a saving of €1,046.06 – €155 = €891.06 a year.

The payback period of an investment is how many years it takes to pay for itself. That is the total cost / the yearly payback. In this case, that’s €4000 / €891.06 = 4.5 years. So, installing the wood burning stove will pay for itself in four and a half years, then save €891.06 * 5 = €4,455.3 over the following five years, and every five years after that.

Payback:

- Cost: €4000

- Saving: €828.88 per year

- Payback period: €4000 / €891.06 = the stove pays for itself in 4.5 years

- Saving over 20 years: €891.06 * 14.5 = €12,920.37

- Yearly Return: 20.72%

That’s a return of 20.72%. A hedge fund manager would be a superstar if he could deliver a return of 20% on your money for even two years in a row. Not only would this investment return that for the next twenty years – it will probably return more. Most of our calculations are comparing cleaner and more efficient energy sources against fossil fuels. Fossil Fuels will almost definitely become more and more expensive in the coming years. The more expensive they become, the more this investment will return.

That’s a lot of money to have to spend on other things!